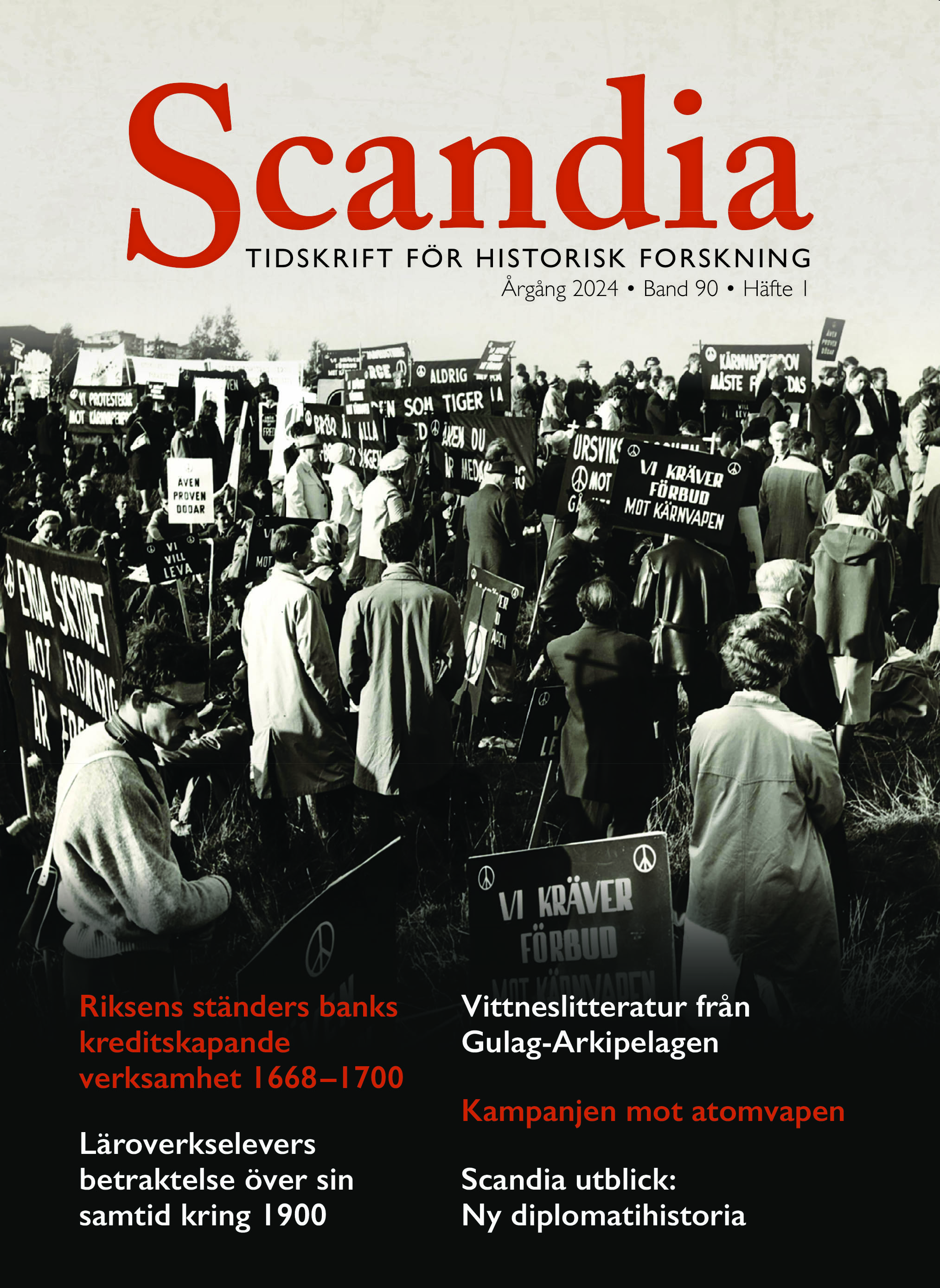

Building Trust: The Swedish Bank of the Estates, 1668–1700

DOI:

https://doi.org/10.47868/scandia.v90i1.26310Keywords:

banking, credit, early modern, Sweden, trustAbstract

By going beyond the Swedish Riksdag’s decision to create Riksens ständers bank (the Bank of the Estates of the Realm), this article shows that the bank’s credit was not seen as fixed and set when the Riksdag was adjourned on October 1, 1668. On the contrary, in a credit market characterized by a weak institutional framework, personal relationships and assessing credibility on the basis of manners and appearances were essential for private and institutional actors alike. The bank constantly had to work on its credit with

regard to competitors and customer wishes and based on the conception of credit in a ”public economy of information.” The bank’s practices in terms of building credit did not materialize in isolation but occurred in a constant dialogue with society at large. What was best for the bank’s credit in theory was not necessarily compatible with the customers’ needs, and the bank’s practices came to be defined by a relationship based on dialogue. Credit and credibility needed to be maintained in an ongoing process for the bank to function. Moreover, it does not seem as if credit was primarily expressed through the design of the bank building’s exterior or interior decorations such as when the Bank of England built its house in the eighteenth century. What mattered more were brick vaults and secure locks, the width of the counters, how the staff behaved in their daily encounters with the clients, and the ability to be frugal with the bank’s resources and thereby prove to be credible.